The Public Accounts and Charges Act 1891 the only extant. Inland Revenue Regulation Act 1890 c.

Inspector Inland Revenue Fbr Result 2022 Answer Key In 2022 Answer Keys Answers Revenue

Director General Customer Strategy and Tax Design.

. TO You are required under section 511 of the Inland Revenue Ordinance Cap. Public Accounts and Charges Act 1891 c. In paragraph 63 of Schedule 2A to the Judicial Pensions.

32 Director General means the Director General of Inland Revenue and includes such other employees of the Inland Revenue Board of Malaysia who are duly authorized by him. A representative of the Minister of Finance not below the rank of a Director. Inland Revenue Board of Malaysia.

Guide for Motor Vehicle Traders PDF 677KB. Directorate General Intelligence Investigation-IR Islamabad. The Commissioner of Inland Revenue will use the data for tax purposes and may disclose the.

Copy and paste this code into your website. Director General of Inland Revenue. When you are selling a second-hand motor vehicle there are two methods to charge GST.

To compute the GST chargeable use GST Computation Template for Sale of New Vehicles XLS 41KB. Sutlej Block Allama Iqbal Town Lahore. Return of Change of Company Secretary and Director of Registered Non-Hong Kong Company AppointmentCessation Section 7911 7912b.

It sets out the interpretation of the Director General in respect of the particular tax law and the policy as well as the procedure applicable to it. Sale of Second-hand vehicle. Below in any communication.

Box 132 Hong Kong. The JLL newsroom keeps you up to date with the latest commercial real estate news corporate updates market transactions and more. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

The Director General may withdraw either wholly or in part by notice of withdrawal or. For every 1 donated to an approved IPC 250 will be deducted from your taxable income next year. For more information please refer to GST.

A tax invoice does not need to be issued for zero-rated supplies exempt supplies and deemed supplies or to a non-GST registered customer. 29 August 2022. 112 to make on this return a true a.

Revenue Tower 5 Gloucester Road Wan Chai Hong Kong. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. Judicial Pensions Act Northern Ireland 1951 c.

Latest from HM Revenue Customs. Apply for NUC Recruitment. 33 Person includes a company a body of persons a limited liability partnership and a corporation sole.

On his part the Managing Director Nigerian Ports Authority NPA Mohammed Bello-Koko said the Lagos seaports are operating beyond their capacity hence the need to optimise the inland dry ports. The applicants are also directed to collect FCSC forms from chairmen of the state civil service commissions in the geo-political zones. Nd correct return of the Assessable Profits or.

The Board of Inland Revenue was created in 1958 and the service gained autonomy with the passing of the FIRS Establishment Act 13 of 2007. General 1 When you received an Employers Return BIR56A you must complete it and lodge with IRD within 1 month even if. Quote the file no.

Directorate General Internal Audit IR Islamabad. The Comptroller-General of the Nigeria. You have to inform the Inland Revenue Department IRD the following.

Immigration Tower 3rd Floor Sector G-81 Islamabad. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. List of ports using the Goods Vehicle Movement Service.

Donate to Community Chest or any approved Institution of a Public Character IPC for causes that benefit the local community and lower your tax payable. The Internal Revenue Service IRS is the revenue service for the United States federal government which is responsible for collecting taxes and administering the Internal Revenue Code the main body of the federal statutory tax lawIt is part of the Department of the Treasury and led by the Commissioner of Internal Revenue who is appointed to a five-year term by the. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

Directorate General of Training Research Inland Revenue Lahore. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and proced ure that are to be applied. Some Business Licenses are granted upon payment of the fee while others may require the approval of other County agencies eg the Fire Department Sheriffs Department Department of Health Services andor Department of Regional Planning or a hearing before the Business.

Director General of Inland Revenue DGIR on any change of accounting period by a company limited liability partnership trust body or co-operative society which has to make payment by instalments on an estimate of tax payable for a year of assessment YA. North-West Kaduna North-East Yola NorthCentral and FCT Mabushi Abuja South-East Owerri South-South Port Harcourt and South-West Ibadan. The Chairman of the Revenue Mobilization Allocation and Fiscal Commission.

Apply for EFCC Recruitment. A director regardless of amount New employment. Holding of General Meetings by Companies during the period of the Novel Coronavirus COVID-19 Pandemic.

A Public Ruling may be withdrawn either wholly or in part by notice of withdrawal or by publication of a new ruling which is inconsistent with it. Containing 58 per cent of the world population in 2020 the EU generated a nominal gross domestic product GDP of around US171 trillion in 2021 constituting. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. All Business License applications require the applicant to pay a non-refundable application fee. If you are aware of someone who has evaded tax in Singapore or have information about some tax-related fraudulent activities you may provide information to IRAS using the reporting templateYour identity and all information documents provided by you will be kept confidential.

The Inland Revenue Regulation Act 1890 shall cease to have. The European Union EU is a voluntary supranational political and economic union of 27 democratic sovereign member states with social market economies that are located primarily in Europe. In general a tax invoice must be issued within 30 days from the time of supply.

Meeting With The President Commissioner Of Inland Revenue From Trinidad And Tobago Inter American Center Of Tax Administrations

Mia Kai Yap Director Inland Revenue Authority Of Singapore Iras Linkedin

Federal Inland Revenue Service Firs

Read This Simple How To Guide On Convening An Annual General Meeting Agm Learn The Steps To Take The Ways You Can Conduct An Agm And Meeting Guide Annual

Federal Inland Revenue Service Firs

Executive Team Department Of Revenue

Commissioner Charles P Rettig Internal Revenue Service

Hong Kong Sar S Inland Revenue Department Update On E Filing Of Profits Tax Returns International Tax Review

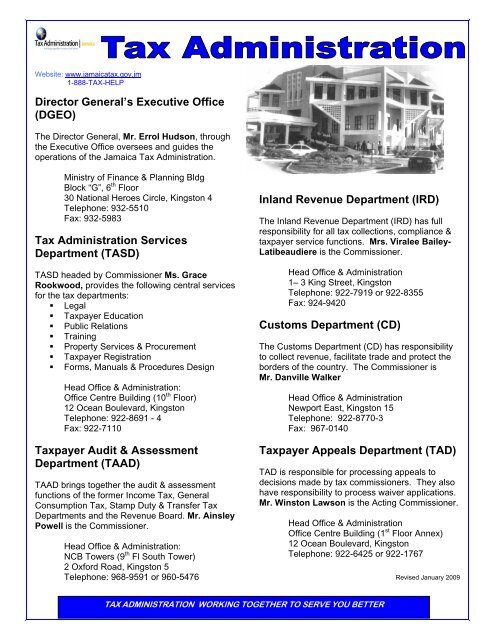

Director General S Executive Office Tax Administration Jamaica Taj

Director General Ministry Of Finance Development Somaliland

Meeting With The President Commissioner Of Inland Revenue From Trinidad And Tobago Inter American Center Of Tax Administrations

Firs Issues Public Notice On Establishment Of Large Taxpayers Office In Awka Lawbreed Blog

The Power Of Data In Digital Transformation Inland Revenue New Zealand Shares Its Experience Global Government Forum

Filing Of Audited Or Un Audited Accounts As Well As Tax Planning Is Very Important The Inland Revenue A Filing Taxes Tax Filing Deadline Financial Statement

Pdf A Case Study Inland Revenue Board Of Malaysia Irbm In Encouraging Malaysian To Pay Taxes

Standard Operation Procedures Sops For Bicycle Riders All Pak Notifications All Traffic Signs Standard Operating Procedure Procedure